alabama delinquent property tax laws

Once you have found a property for which you want to apply select the CS Number link to generate an online application. Code 40-10-120 40-10-29 Ala.

The Alabama Department of Revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help them complete the quiet title action and become the undisputed owner.

. Tax sales are the mechanism by which counties collect delinquent ad valorem taxes. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Click for Answers ASAP.

A In the event that the local governing body city or county elects to participate in the program under this chapter by entering into an intergovernmental cooperation agreement with the authority the authority shall hold in its name any tax delinquent properties within the territorial jurisdiction of the local governing body which. The first involves the county selling the taxpayers land to pay for. Generally there is a six-year statute of limitations on collecting delinquent taxes in Alabama.

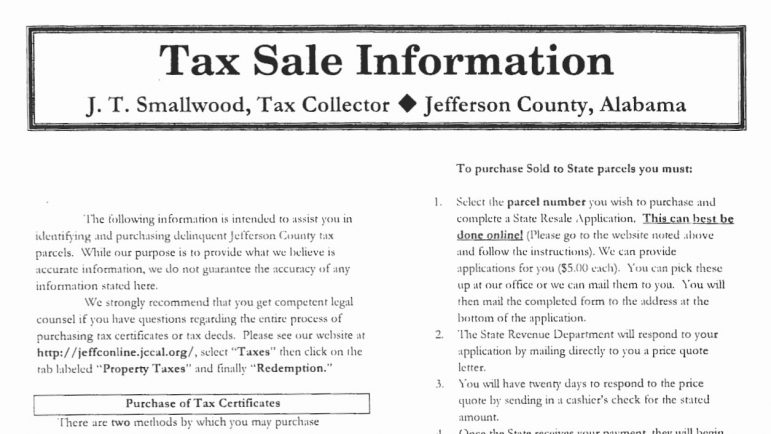

Tax Sales of Real Property in Alabama. The federal law had been updated in 1998 but the state law had not followed suit yet. The Revenue Commissioner is authorized to secure payment of delinquent taxes through a tax lien auction in which the perpetual first priority lien provided by Alabama Code 40-1-3 is sold and transferred to a purchaser through a public auction to recover any taxes assessed and levied against the property along with.

Interested in buying tax properties in Alabama now. Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home. Up to 25 cash back Alabama Tax Lien Sales.

This is official notice that Tax Collector Jones has chosen. Step 1 Find out how tax sales are conducted in your area. Once there is a tax lien on your home the taxing authority may hold a tax lien sale.

Call your county tax collection office better yet visit in person if you can and ask about the procedures in your area. In Alabama taxes are due on October 1 and become delinquent on January 1. Whats more Alabama actually gives purchasers the right to receive all.

Click a county below to see the states over-the-counter inventory - you can even apply for a price quote. For example in 2011 a woman who was granted innocent spouse relief from the IRS was denied that same relief in Alabama. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State.

Alabama law Code of Alabama Title 40 Chapter 10 Sale of Land. Step 2 Attend an auction. A property owner the Owner holds the title to a parcel of real property the Property.

Connect with a Verified Lawyer 11 and Get Legal Questions Answered. If another party buys the lien you may redeem the property at any time within three years from the date of the sale. Tax delinquent properties are available in Alabama year-round.

If the Owner fails to pay those taxes then the. Read more Tax Delinquent Property and Land Sales Alabama Department of. Good news - You dont have to wait for the annual tax sales.

There are two types of tax sales in Alabama. Ad Need Some Law Help. The excess amount shall be credited to the county general fund ARS.

However the statute can vary based. Susan Jones Tuscaloosa County Tax Collector Tuscaloosa Alabama has been vested with the sole authority under Alabama Code 40-10-180 1975 to select whether Tuscaloosa County Alabama shall utilize the sale of tax lien or the sale of property to collect delinquent property taxes. The winning bidder at the Montgomery County Alabama tax sale is the bidder who pays the largest amount in excess of the delinquent taxes delinquent interest and fees.

Get Info on Petitions to File a Suit Common Law Marriage and More. The steps to buying a property for delinquent taxes. 9 hours agoIt outlined that the Uniform Delinquent Tax Enforcement Act adopted in 1993 provides a statutory scheme for the enforcement and collection of delinquent real property taxes at the local level.

In the online application enter. Property taxes are due October 1 and are delinquent after December 31 of each. When purchasers buy tax lien certificates in Alabama they are paying someone elses delinquent property taxes.

Section 24-9-6Acquisition of tax delinquent properties. Property Tax Division. A Alabama tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Jefferson County Alabama to the investor.

Every year ad valorem taxes the Taxes are due to the state county and city if applicable based on the value of the Property. To the Code of Alabama section 40-10-180 to adopt and affirm the Tax Lien. The 2022 Alabama Tax Auction Season completed on June 3 2022.

In other words there is not a continuous chain of title and a judge has to issue an order declaring you the rightful owner.

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

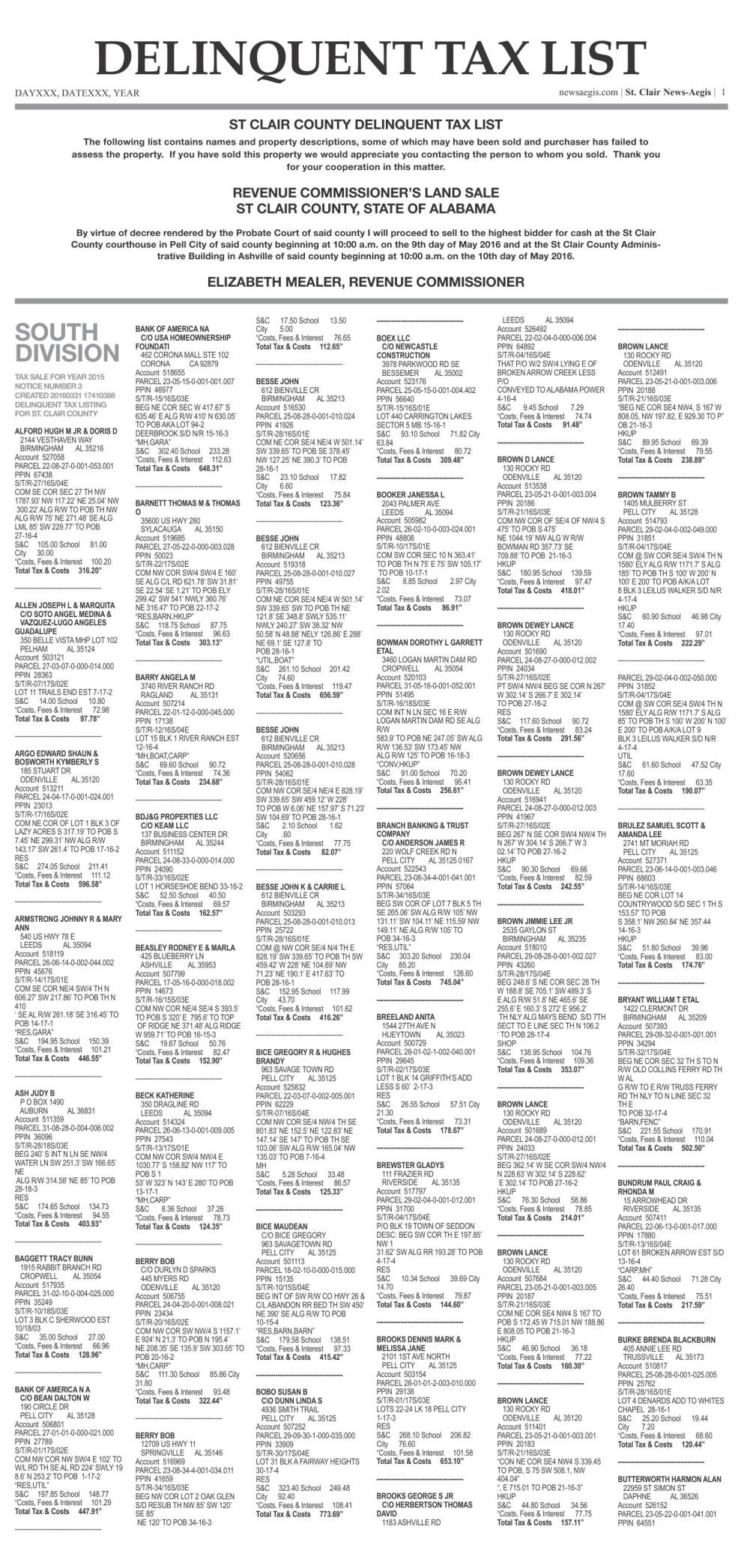

Delinquent Property Tax List St Clair County 2016 Newsaegis Com

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster